The Phoenix Suns: A 2025-26 Offseason Outlook

Overview

The Phoenix Suns are at a crossroads. In 2020-21, the organization was just two wins away from hoisting the Larry O’Brien trophy. Led by franchise cornerstone Devin Booker, the Suns had a young core well-positioned to compete for championships for years to come. A mere four seasons later, Booker is the sole remaining player from that team, and the young core is no more. It is fair to say that the past four seasons have not gone according to plan. The organization’s all-out pursuit of a title led to “win-now” move after “win-now” move. This translated to sending out nearly every key piece not named Booker — and every single draft pick in the team’s asset cabinet, all in an effort to acquire stars and cobble together a championship roster. The Suns have also hired (and fired) three head coaches in three years. And yet, despite the Front Offices’s stated ambition, the team has not made it back to the Western Conference Finals — let alone another Finals appearance. This downward trend culminated in the 2024-25 season, where, for the first time in five years, the Suns missed the playoffs entirely.

This season, in particular, feels like a gut-check — and perhaps the final nail in the coffin for this iteration of the team. Kevn Durant, for whom the Suns traded nearly every key asset for, is likely to be playing elsewhere next season. And Bradley Beal, the player for whom the organization traded its remaining assets, could also end up elsewhere. Beal’s contract (and its ripple effects) has backed the Suns into a corner in more ways than one. Tellingly, the most expensive NBA roster ever assembled is about to be put under the microscope.

It is also fair to say that this upcoming offseason for the Suns might be one of the most important in franchise history. The moves that the Front Office makes — or does not make — will drastically reshape the team’s short- and long-term future. Outside of Booker, the future of every player on the roster figures to be evaluated. With a severe lack of traditional assets, the organization may need to get creative to navigate the offseason landscape. The path forward will ultimately be influenced by owner Mat Ishbia who, since buying the team three years ago, has been all gas, no brakes. Will that strategy continue? Or will we see a pivot in approach from a team that has launched itself deep into second apron territory — perhaps in pursuit of greater flexibility? This newsletter will present a foundational analysis of the Suns’ current financial picture and strategic standing heading into the 2025-26 offseason. I will highlight the team’s largest requisites, explore the most pressing questions the team faces, and forecast the organization’s tools for roster-building and key factors that could influence its planning. Lastly, I will present my own perspective about how the Suns should approach the summer — and the potential pathways forward.

Finally, if you would like a deliverable version of this newsletter that has additional tidbits of information, feel free to download the PDF attached below!

Season Recap

Record: 36-46 (11th in WCF)

Playoff Result: Missed the Playoffs

Notable Moves:

Acquired Nick Richards and a 2nd Round Pick for Josh Okogie and three 2nd Round Picks

Acquired Cody Martin, Vasa Micic, and a 2026 2nd Round Pick for Jusuf Nurkic and a 2026 1st Round Pick

Acquired three future 1st Round Picks for a 2031 1st Round Pick

Main Offseason Questions

What happens with Durant?

Can a trade be identified that satisfies all parties?

Can the team get under the 2nd Apron in 2025-26?

Does the organization want to position itself to maximize flexibility in 2026-27, and, if yes, to what extent does it want its books completely wiped clean?

What happens with Beal? Is cutting him this offseason (and having his full salary as dead cap for 2 seasons) worth more than waiving and stretching his contract next year?

What direction does the organization want to go in, and how does that impact its offseason plans?

What is the team’s identity?

Does the team want to shed salary to lessen its Tax payment?

Will Booker extend?

Biggest Needs

Financial and roster-building flexibility

Clarity and a new identity

Get under the 2nd Apron (or lower the Team Salary as much as possible to approach it)

Reiterate Booker as franchise centerpiece

Finding a home for Durant

Rotation player upgrades to increase the roster’s depth

To find value on the veteran minimum market and to use the accessible limited roster-building tools

Unless the team positions itself to get under the 2nd Apron where more tools open up

Solving the Beal question - whether he should be cut or kept (since a trade is unlikely), and whether biting the bullet by cutting him would ultimately be worthwhile (in other words, timing matters)

Defense, defense, defense

Hire a Head Coach

The Financials

As currently constructed, the Suns head into the 2025-26 offseason a projected $11M over the 2nd Apron, $23M over the 1st Apron, and $31.3M over the Tax, and with ten contracts on the books. Of the ten, eight are fully guaranteed. The organization has an additional $3.8M in waived salary (Little and Liddell) and will have 5 UFAs hit the market. Additionally, one player has a TO, and two have contracts that are NG. At the present moment, the Suns face a projected $168.9M Repeater Tax payment, which, in addition to the $218M payroll, means that the total roster payment will top $384M. Looking forward past 2025-26, the Suns project to continue to have restricted roster-building flexibility impacted by being a projected (near) Tax and/or Apron team. However, there is a path toward increased flexibility and room for maneuverability due to having only three non-rookie scale contracts that extend past 2026-27. In 2026-27, the team currently sits with have six players under contract; however, this number will likely change given the fact that everyone on the roster besides Booker could/should be on the table. That said, as currently constructed, the team would have $73.2M in 2nd Apron space to fill at minimum 8 roster spots.

Free Agents, Options, and Tools to Upgrade

It is important to note that the Suns, as currently constructed, have a financial projection that places them in the 2nd Apron, which would result in severely restricted roster-building abilities. However, this standing will likely change as the team navigates what will be a complex and busy offseason. This means that the financial starting point with which the team heads into the offseason is going to be drastically different than the end point. This financial picture will, in turn, impact what the organization can do in terms of strategic capabilities. Simply getting under the 2nd Apron would open up significantly more pathways for roster-building. However, the mere fact that the Suns might have access to more building block tools does not mean that the team will be able to use them. This is because of how many of these newly added tools would carry 2nd Apron Hard Cap implications. If the Team Salary is far enough away from the 2nd Apron threshold, getting Hard Capped might not matter as much. However, because the team still needs to fill out the roster, every dollar allocated is crucial. At this moment, the Suns have ten contracts on the books for 2025-26 and need to hit fourteen for the season. The rostered salary number is likely to adjust; however, regardless of the final figure, if the organization manages to get under the 2nd Apron but Hard Caps itself at it (say, by using the TMLE or aggregating salary in a trade), it will still need to have enough room beneath the threshold to fill out the rest of its roster. This Apron and Hard Cap dance is important to track as the Suns’ offseason unfolds.

Potential Contracts and Valuations

There are two important potential player extensions of note that need to be discussed when it comes to the Suns’ offseason and future: Booker and Durant. Booker becomes extension eligible this offseason and will have the ability to tack on two more years of Supermax money to his current contract. Booker currently has 3 years and $171M left on his deal, which runs through 2027-28. As such, he can add an additional 2 years, which would look as follows:

This 2-year $149M extension would tie Booker to Phoenix through the 2029-30 season—which represents a massive commitment. Based on his apparent desire to stay with the Suns, there seems to be a real chance that he will sign on. However, is it a foregone conclusion that Booker extends this summer? Or could he wait until the next offseason, when he could potentially tack on more years? There might also be strategic reasons for waiting. Could Booker want to see how the organization handles this upcoming offseason—and perhaps even the 2026-27 one—before locking in? We certainly have watched players use this approach before, both to apply pressure on their respective Front Offices and to keep their own futures flexible in case the team's direction does not align with their own expectations. It is certainly a situation to monitor; however, I would presume that the Suns’ Front Office will push him to extend.

Moving onto Durant, his potential extension (or lack thereof) impacts the Suns in a different way, specifically in trade talks. With the Suns and Durant likely heading toward a split, it has been reported that the Suns “allegedly” will work with Durant and his personal team to find a home that satisfies all parties. It is important to note that this reported willingness does not seem to correspond with the facts on the ground. If given the choice, it is safe to assume that the Suns would likely prioritize return packages that meet the team’s demands and priorities over those of Durant. However, Durant has one clear leverage card to play: the fact that he will be on an expiring contract in 2025-26. In theory, Durant could opt to pursue Free Agency in 2026-27 if he is not traded to a team to which he wants to go. This could result in several twists in trade talks, including the wariness of potential acquiring teams to send out significant trade packages without the assurance of Durant staying for more than the year. This, in turn, could force the Suns to heavily consider where Durant wants to go. The Suns will presumably go to Durant and ask him to provide an indication of the teams with which he would be willing to sign an extension. The idea of this 2-year $123.8M extension will hover over trade talks and will probably play a large role in determining the outcome of the situation. The extension itself (which is limited by the over-38 rule) is charted below.

The Direction

The Suns face a pivotal choice this summer. Despite Ishbia’s consistent desire to contend, the organization may have a chance to pivot—potentially setting itself up for greater long-term flexibility. It all starts with the kind of return package the Front Office seeks in a potential Durant trade. Still, with other “outs” on the roster, the team could reduce salary to approach the 2nd Apron threshold and lower its Tax payment. The Beal question remains--what will the outcome be? Ultimately if the long-term goal is to construct the best possible roster around Booker, this should be the top priority. In the short term, to position the organization in the best place possible to build moving forward, having a form of “reset” using the 2025-26 season and offseason could be wise.

The Beal Factor

Simply put, the Beal experiment has not panned out for the Suns. Beal has underperformed and his contract has become one of the worst value deals in the league—so bad that the Suns likely will not be able to trade him, notwithstanding the no-trade clause his contract contains. Beal is owed $111M over the next two seasons (with the second being a PO). One issue the organization faces is that it currently cannot waive-and-stretch Beal’s contract, something it has done with players in the past. Under CBA rules, a team cannot stretch a salary if dead money from waived players would exceed 15% of the salary cap in any future season—in this case, it would. Perhaps negotiating a buyout at a lower number and then stretching Beal could be an option. Regardless, his contract has backed the Suns into a corner, forcing the team to make moves it might not have otherwise considered. The question will be about the timing. Is the relationship completely dead with an imminent divorce a necessity, or could the team decide to keep Beal for the season to lighten the waive-and-stretch load in 2026-27.

For example, if the two parties were to agree upon a buy-out whereby Beal gives back money to help the Suns comply with the waived salary rule, the team would have his dead cap spread out over five years. However, if both parties were to wait until following offseason, it would only be three years. Additionally, the franchise would have less money to spread out given the fact that Beal would be on an expiring contract (and he could, in theory, agree to give some of it back to further lower the amount). This will surely be an option that the Suns might or should consider. This option is reflected in the potential offseason pathways described below.

Approach and Objectives

In my opinion, the Suns’ offseason approach should center on clarifying the team’s long-term direction - both in terms of roster-building and reestablishing an identity. A key component of this approach involves maximizing the return from a potential Kevin Durant trade—ensuring that such deal aligns with broader strategic priorities, including roster balance, financial flexibility, and long-term competitiveness. Additionally, there should be a pressing need to reduce the Team Salary, particularly with respect to the Luxury Tax and the 2nd Apron threshold — pushing to lower the Tax payment and position itself closer to, or under, the 2nd Apron. The organization must evaluate its “mid-tier” contracts, determining which players should be retained and which might be better utilized as trade assets (such as exploring the possibility of exchanging Grayson Allen’s long-term deal for one that expires in 2026-27). The Front Office should use this roster-building direction as a lens when handling the Beal situation. The chosen pathway will ultimately determine the most optimal outcome for Beal, and whether he is kept, bought out, or waived at full salary. Throughout this process, the goal should be to improve roster depth with players who complement and elevate Booker. Finally, all players (other than Booker) should be considered available in trade talks, and the team should pursue Booker’s extension to solidify him as the foundation for the franchise’s next era. Overall, personally speaking, I would shift the focus toward maximizing flexibility during the 2026-27 offseason where the team can make significant strides toward accomplishing several of the goals listed above; however, if moves can be made to start this process in 2025-26, that should be done.

Potential Paths

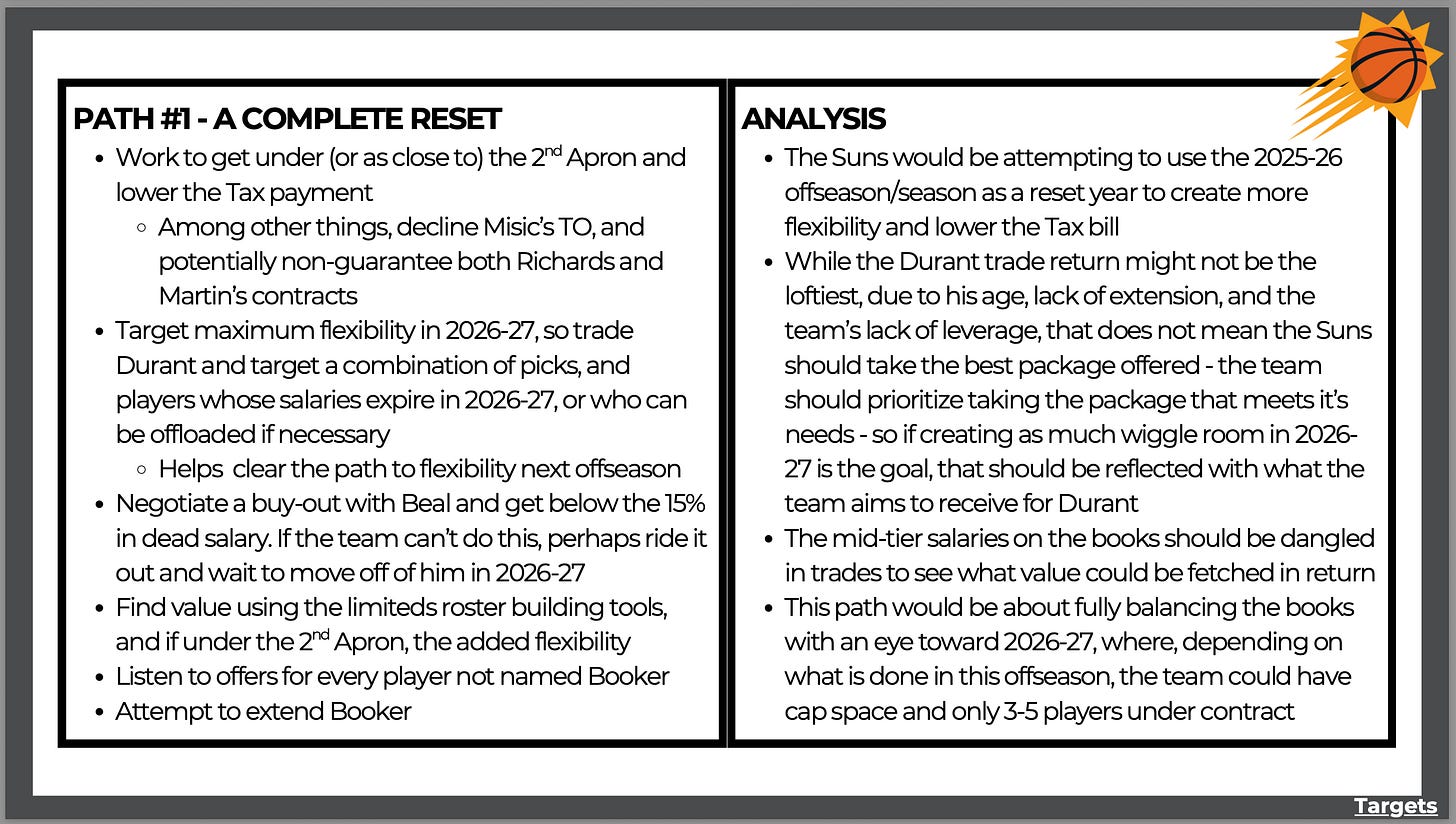

The theme of the first pathway would represent a step in a different direction from that which the Suns have been operating: toward an all-out pursuit of flexibility while using the 2025-26 season as a reset year. The Suns have been deep into the 2nd Apron, and, resultantly, have been forced into abiding by its severe and lengthy list of restrictions. This has handicapped the organization’s ability to maneuver from a roster-building perspective, which, in part, has contributed to pigeon-holing the team into its current standing on the league landscape.

In recent seasons, there has been a notable shift in how teams view Apron status, which has led several organizations to recalculate their respective financial positioning. For example, during the last year, the Clippers, the Bucks, the Heat, the Sixers, and the Mavericks, among others, all made either a move, or a series of moves, to duck the Apron(s). The results of this league repositioning seem to be promising, in large part, due to the added flexibility gained. It would be wise for the Suns to scrutinize the actions of these teams and look to replicate that idea. However, because Phoenix is so deep into the 2nd Apron and still has work to do in rounding out the roster, the repositioning projects to be a lengthy process (with significant salary shedding and roster tinkering) to navigate to a position to duck it this season. As stated above, if the organization pulls it off and gets under the 2nd Apron, it will still need enough room under it to fill out the rest of the roster. Depending on its financial standing, a 2nd Apron Hard Cap (for example triggered by using the TMLE or salary aggregation in a trade) could handicap the team because of the need to fill roster spots being neutralized by a lack of space. This Apron and Hard Cap dance is something to monitor as it will require clever Salary Cap planning.

Regardless, getting out of the 2nd Apron — or lowering the Team Salary as much as possible to approach it — needs to be a top priority. That said, building off the work that the organization does in 2025-26, the Suns organization could position itself to completely escape both the Apron and Tax in 2026-27 by clearing the books and retaining only 3–5 players under contract — presumably including Booker and the two current rookies. If this is the path that the Front Offices chooses, then this is the lens that must dictate all aspects of the offseason, inclusive of trade talks.

While the return in a Durant trade might not be lofty — due to his age, lack of extension, and the team’s limited leverage — it does not mean that Phoenix should accept the best offer on the table. With flexibility in mind, the team should instead prioritize a return that fits its strategic goals. If escaping the 2nd Apron is the objective, while creating as much wiggle-room as possible (in the future), this should be reflected in what the team prioritizes for Durant — ideally, expiring contracts or ones that can be offloaded. Additionally, taking back salaries that add up to the lower range of possible salary matching rules should be an objective, as it means more salary shed (for example, if the salaries in the return package add up to $48M, it results in a $6M shed because Durant’s salary is $54M). The Suns should also explore trade options for its mid-tier salaries that extend beyond this season (e.g. Allen and O’Neale). Declining Micic’s team option and non-guaranteeing either (or both) of Martin’s and Richard’s contracts could also be a lever to pull if the team is aiming for immediate financial and Tax relief. For example, if the Suns parted ways with Micic and Martin, the organization would save roughly $115.9M against the Tax and would temporarily go under the 2nd Apron (with a significant number of roster spots to fill).

Speaking of financial relief, the question of Beal’s future looms large. As explained in the Beal Factor section above, there are several options for the Suns, each of which would directly impact offseason plans. The team could opt to “rip the band-aid off” and waive Beal outright, having his full salary count against the books for two seasons. The Suns could buy Beal out, trying to have him give a sum-certain back, thereby reducing the dead salary cap hit. This would ideally be aided by Beal securing a new contract elsewhere that would help make up for what he gives back. The team would specifically aim to bring the dead-salary number to a point where it does not exceed the 15% total allowed for stretched salary. This would allow the Suns to stretch it across five seasons. Alternatively, if the team cannot accomplish this, it could consider keeping Beal for the season and waive-and-stretch him next summer, eating the dead salary annually across the next three years. Regardless, the buy-out and waive-and-stretch approach would each give the Suns more wiggle room next offseason, help in its push to duck the 2nd Apron, and save the team millions against the Tax.

In terms of additions this summer, finding value on the veteran minimum market is a must. The team should also try to identify at least one legitimate rotation upgrade — ideally someone who brings both defense and shooting and fits well alongside Booker, to add to its new foundation. Speaking of Booker, the team should attempt to extend him. Finally, if the team is able to free certain roster-building tools, it needs to maximize those as well, so long as the team has its financials lined-up.

Similar to the first path, the Suns would be using this offseason to create more flexibility and try and duck the 2nd Apron. However, where the second path deviates from the first is an express willingness to take back longer-term money that extends past 2025-26 to start building out the foundation. By adjusting its priorities to be more amenable, this could aid the organization in the Durant trade talks. It all comes down to the opportunity cost and whether adding the longer-term money is worth losing the maximum potential wiggle-room in the long run. Based on the context and circumstances of who the players are, the team could justify the investment and the future exchange of flexibility. Finally, when compared, the underlying motivations and reasoning behind both pathways would be the same.

Potential Free Agent Targets: *will be updated*

Potential Trade Partners: Rockets, Mavericks, Knicks, Clippers, Spurs, Wolves, Heat, Magic

Potential Trade Ideas *will continue to be updated*:

Trade #1

Suns: Powell, Bogdanovic, Jones Jr., Pick(s)

Clippers: Durant

Trade #2

Suns: Green, Smith Jr., Landale, Pick #10 or Future Pick(s)

Rockets: Durant

Third Team: Salary to avoid 1st Apron Hard-Cap

Trade #3

Suns: Two of Barnes, Vassell, and Johnson, plus a combination of Sochan and/or Picks

Spurs: Durant

Trade #4

Suns: Randle OR Gobert and a combination of DiVincenzo, Conley, Dillingham, Shannon Jr., and a Pick

Third Team: One of the group of players from the second bucket for Salary Matching (would depend on who was going to the Suns)

Wolves: Durant

Trade #5

Suns: A combination of Wiggins, Robinson and Rozier for salary purposes, and a combination of Ware, Jovic, and Picks

Heat: Durant

Final Thoughts

The Suns figure to be one of the more active teams over the coming months and will presumably have a large share of the spotlight. As the team looks to reconstruct and remodel itself, what the organization chooses to do and not do will not only be fascinating to monitor, but will hint at its larger plans beyond 2025-26.